It started out as a referral from a friend in the e-commerce space.

He wasn’t taking on clients, and this particular one got severely burned by one of the shiny agencies whose names you hear a lot in Facebook circles. I agreed to talk with them.

It was evident from the get-go that they were panicked. Rightfully so.

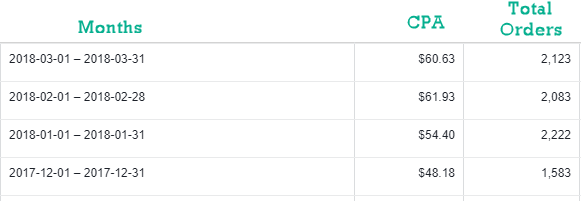

They previously had someone managing their account that had the CPA around the $30 mark. But starting in January, it began inching up and the person had no explanation. “He just kept doing the same thing he’d been doing,” they explained. Frustrated, they looked elsewhere.

That’s when they got the sales pitch by this agency who brags about their elite-ness.

They signed on at the beginning of March and fired the previous manager.

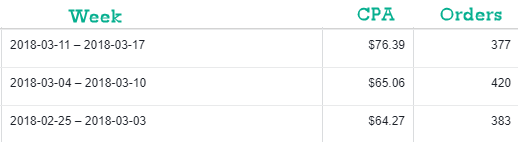

Their CPA shot up to $80 immediately. It didn’t get much better from there, hovering in the low $70 range. They couldn’t scale the spend any higher because they weren’t hitting the $50 CPA goal.

Meanwhile, the client had a BUNCH of inventory laying around that wasn’t moving. The relationships with their suppliers were suffering because their minimum orders weren’t being met. They were hosing money into ads that weren’t turning a profit for them.

It was a mess. I could tell in my exchanges with them they were desperate for me to say “Yes, of course I can turn this around.”

However, I basically never say that. I cannot control the Facebook algorithm. I cannot control what their competitors do. There’s just a lot at work that needs to shake out correctly.

What I DID feel confident in saying was that I could get the results better than what they were experiencing. I never committed to their constant question: “Yes, but can you hit $X CPA?”

There’s no way of knowing that. And it was clear something had gone off the rails in starting in January with the old manager, and then flew into a full-raging dumpster fire once this agency got their hands on it.

In the past 6 weeks, since taking the account over, I have realized it’s the perfect case study for how many things can go wrong, and how much time and effort it can take to get from this CPA:

To this one:

![]()

There wasn’t just one thing that can be learned from it, so I’m breaking this into a few parts, each one examining a different aspect of the dumpster fire we had to turn around.

And that, my friends, is one of the main lessons of this series: there are no easy fixes when things go far enough down the rabbit hole.

It requires partnership between the client and the provider, and working together to piece together how to get things back in black.

The Inception of the CPA Problem

As it turns out, there were so many things going wrong within the account it was like a big ball of string I had to unwind. The biggest, most pressing issue was the problem hadn’t necessarily started with this most recent agency…the client said it had started in early January.

But the problem wasn’t getting better, and this wasn’t a small account with a spend north of $120k a month.

Whenever there are problems like this, it’s time to Sherlock Holmes this thing.

Possibility #1: Holiday Hangover?

Naturally, there was the question of whether it was tied to the holiday season.

Most of the setup was based on lookalike audiences. When you start getting people that aren’t your “usual” customer flooding the site and Purchase data (especially a lengthy time like the holiday shopping season), it can start to wreck results once that period of time ends. The pixel stumbles around, confused as to why the people it had humming along are suddenly not buying. You get the wrong people coming through the site, less purchases, which then equals less Purchase data for Facebook Ads to use.

It’s a death spiral that’s hard to break out of. There are ways around it, but none of them had been implemented.

So, that was one possibility.

Possibility #2: The New Agency Did Do a Big No-No

Now, this problem started before Shiny Agency took over. But it definitely got worse at that point. This is where I started to know we’d have to peel through a lot of layers to diagnose the problem.

Why?

Because I basically had two sets of history to unpack: what the screw-ups were of the most recent agency, and then further back with the previous provider to figure out where the initial derailment started.

It was likely they were two different things, though the initial derailment was probably exacerbating the issues of the recent agency.

At first glance, I saw the most recent agency had paused all the old stuff. Like, even the stuff that was working.

Anyone wanna guess what week they took over?

So was it now Holiday Hangover + Dopey Account Management?

These were the first two things I assumed. And then I realized how much more complex it was going to get.

Why?

Because…the client explained their website setup and checkout process.

Possibility #3: Really Unfavorable Setup for Ecomm

Unlike most ecomm businesses in existence, this advertiser doesn’t have a central storefront. They have two different websites, with specific URL paths that take the user through the buying process.

Oh, and they have more than one product type with multiple options the user picks as they go through the sale.

So now it’s not like one path is broken, then the question became…is it just one particular product path that’s broken? Which one? Did the pixel disappear from some pages?

P.S. There is no in-house developer for these pages/storefronts. Wheeeeeeeeee fun!

So….what was it?

Things had to unfortunately get slightly worse for awhile until they got better. But the process it took is the key: it’s the PERFECT case study in how to fix the ultimate sh*tstorm, from which both agencies and clients can learn.

Stay tuned for the next installment, where I take you through what my investigations revealed.