This is the second installment in a case study about a Facebook Ad account turnaround. If you haven’t read Part I, you should!

Given the myriad reasons this account could have turned into a smoking heap of a tire fire, I needed to be really careful to solve the individual issues causing it. Based on the timeline of it going downhill and then accelerating once the new agency took over, I couldn’t assume that it was just one problem.

It’s also important to remember that the client was extremely panicked while I was working through the whole next part. Lots of creative was pushed at me to launch, desperate emails were sent…it was an emotional time for all involved, as they were on the brink of losing their supplier relationships. They were understandably scared and tossing band-aids at me while I tried to explain that what was needed was open-heart surgery.

To keep this story straight, there’s First Manager, which was the practitioner who originally managed this account and did a solid job.

Then there’s Shiny Agency, who was hired as First Manager’s stuff started to fail and wasn’t recovering.

I was the person that took it over after Shiny Agency.

Back to the Beginning, a Very Good Place to Start

The first thing I did was look at the old campaigns that were running under First Manager. They had all been ruthlessly paused by Shiny Agency, so I first wanted to test them and see if their fundamental behavior changed, or if they retained the same behavior when they were simply turned back on.

I flipped them on, and a few days later, their results weren’t great.

They weren’t as atrocious as Shiny Agency’s attempt…the CPA was a little lower and volume didn’t seem as erratic…but they definitely were not performing like they did in their heyday.

The ad sets were not that old, so I took that as a sign that whatever the issue was, it had grown in the time the ad sets had been shut down.

However, I Took Notice of Something

Most of the previous campaigns that ran under First Manager relied heavily on lookalike audiences.

The fact they started to fail was telling to me.

To be clear, it’s not unusual for lookalikes to start to fail at a certain point, and there are usually two things that cause it:

- Trying to scale up the spend when you use a lookalike audience within a conversion-focused campaign. You can usually scale these to a certain point of efficiency, and then after that they start to suck.

- When something about the audience data going through the pixel changes. It starts to change out the audience profile…but that’s howFacebook finds lookalikes, and if it’s something that screws it up, well, that’s a problem.

In looking at the history, there was no major spend scale that was attempted. Things had run pretty status quo.

That told me it was likely the second thing.

The Death Spiral of Dirty Data

The client sells a product line that is very similar in price, with one small $20 product that gets people into their funnel, basically. We’ll refer to them as Small Fry vs. Big Potato (their normal product line which sells for around $200) for the purposes of clarity.

So far as I knew, both of these products had run and sold that way for awhile, pre-dating when the issues started, and the client said it was an extremely small proportion of the spend/results.

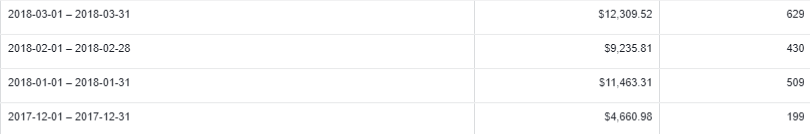

So I looked for myself. This was the spend and number of purchases by month JUST for the Small Fry:

They actually didn’t start selling it until December, and scaled spend on it drastically from December to January…the results started to tank at in mid-January. RED FLAG, Y’ALL.

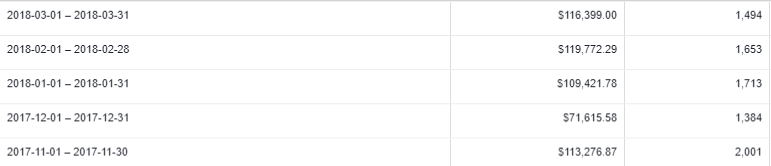

This was the rest of the account that focuses on Big Potato:

The spend was practically slashed in half between November and December, right into the time frame when introduced Small Fry into the mix.

The client wasn’t necessarily WRONG in their statement that Small Fry wasn’t a big part of their spend….the proportion of that $20 loss-leader product was quite small compared to the account at large.

The problem was the influx rate of Small Fry’s purchase data into the Facebook pixel combined with taking their foot off the gas of the Bit Potato.

Small Fry launched in December. The issues started in January. To them, that Small Fry introduction pre-dated the problems, but in a Facebook pixel’s little life? Not so. The impact was minimal when it was initially launched, which was why the client didn’t think that was the issue.

But look closely again at December.

Small Fry was launched, right as the spend was slashed by 45% on Big Potato. That’s what I believe kicked off the problem. The proportions shifted quickly and there was a humongous disparity in the prices of these two items.

Then…it snowballed.

Spend tripled on Small Fry in January. So now you have aggressive growth of an audience buying something for $20 clashing with an audience that was traditionally spending around $200.

The icing on the cake was the declining volume Big Potato sales month over month. The CPA was abysmal, so they cut spend to it, which made the problem worse.

Band-Aids Are Not a Substitute for Heart Surgery

The first thing that struck me was Shiny Agency never looked at any of this. It never seemed to cross their mind there was a larger problem, which makes me want to scream.

They went on charging this client likely 15% of their spend in fees per month, and sticking band-aids over a gaping wound, wondering why it wouldn’t stop bleeding.

They hold themselves out as a Facebook Ads-expertise agency. Shame on them.

I expect clients to do something like that, simply because I don’t expect the average Facebook Ads advertiser to know or figure any of this stuff out – it’s why they’re paying an agency.

So What Happens Next?

So we knew how to get the patient to stop coding on the table…

But what about the repair process of the pixel?

Things don’t magically get better because you cut off the supply of bad data, and it was far from the only problem the previous agency caused.

However, I knew now that is we fixed it, the foundation wouldn’t be cracked going forward. At that point, it became a race against time to regain results and do it FAST before the client lost faith, as well as their business.

What else did I uncover? Stay tuned for Part III, in which I’ll cover the further sins of Shiny Agency.